An Proven Investment Strategy

When contemplating investing with a long-term perspective, it probably is overwhelming to consider all the different options that are available to you. For many of us that do not have a lot an extra money at the end of a month, a simple way to invest is put a small amount away on a regular basis. This type of investing, called Dollar Cost Averaging, is very boring, but very effective especially when one is just starting out with a new account. Many of my former clients engaged in this concept on a weekly, bi-weekly, monthly, or even annually depending on their desires and availability of cash.

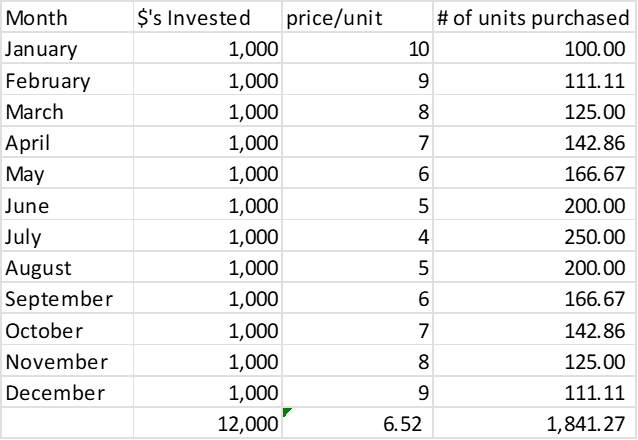

I have created this spread sheet to show what would happen if an investor were to invest $1,000/month to purchase units in a mutual fund that has a price of $10/unit on January 1st. On the first of each of the following months to July 1st, the price drops by $1.00 per month and then in August the price starts go up by $1.00/month. At the end of the 12-month cycle, the price has recovered to $9.00. At year end year, the investor has 1841.27 units at $9.00/unit for a total investment value of $16,571.43. The rate of return for this happy person is 38% (16,571.43/12,000.00)!

Your investment goal is to look for ways to get the highest number of units or shares at the lowest possible price per unit. Having a low ACB (adjusted cost base) should always be your goal!

My next blog will continue the theme of Dollar Cost Averaging.

*Dollar Cost Averaging works quite well with investment funds, but one should be careful with highly speculative investments whose underlying companies could go under. *

Al’s Nuggets:

- If you were wondering if you should work with an advisor, check out this: https://www.fidelity.ca/en/advicecreateswealth/

- People will purchase tomato soup by the case when on sale…. buying investment funds is like buying tomato soup on sale!